When you hear the term Customer Lifetime Value (CLV), what comes to mind? It’s not just about that first sale. Think of it as predicting the total net profit your business will make from a single customer over the entire course of your relationship with them.

Imagine your favourite local coffee shop. You're not just a single $5 latte to them. Over years of daily visits, you represent hundreds, maybe even thousands, of dollars. That's the essence of CLV, and it's a critical gauge of your business's long-term health.

Understanding the True Worth of a Customer

At its heart, understanding what is customer lifetime value means seeing past the initial transaction. It’s a shift in perspective—moving away from a relentless focus on short-term sales targets and toward building lasting, profitable relationships. Instead of viewing a new client as a one-time win, you start to see the bigger picture: their potential future value.

This change in mindset is huge. It gives you a solid, data-backed reason to invest in the things that truly build loyalty and keep customers coming back, like exceptional customer service or personalized follow-ups. You can justify spending on retention, rather than just pouring the entire budget into acquiring new leads who might buy once and disappear.

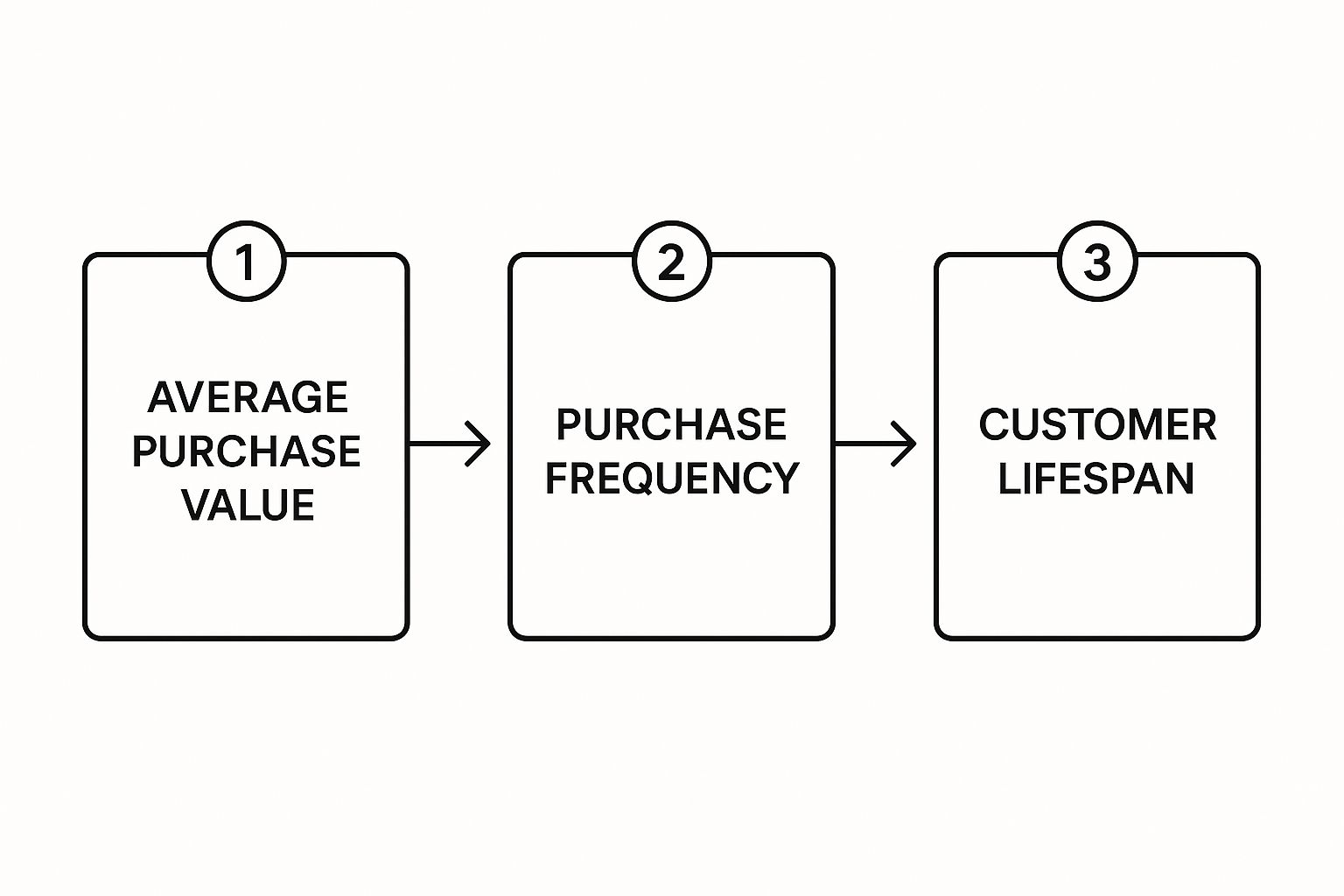

To truly grasp CLV, it helps to break it down into its core parts. Each variable tells a piece of the story about your customer relationships.

Core Components of Customer Lifetime Value

table block not supported

Putting these pieces together helps you build a much clearer picture of what each customer relationship is actually worth, moving beyond just that first sale.

Why CLV Is More Than Just a Number

CLV isn't some abstract financial figure to be filed away in a report. For sales teams, it's a powerful strategic tool that should guide everyday decisions. Once you know the potential long-term worth of a customer, you can start making much smarter choices about:

- Marketing Spend: How much can you realistically spend to acquire a new customer and still turn a profit over their entire lifespan?

- Sales Focus: Which customer profiles are the most valuable? CLV helps you identify and prioritize the segments that drive the most long-term revenue.

- Customer Service: What level of investment is justified to keep an existing customer happy versus what it costs to find a new one?

- Product Development: What new features or services could you introduce that would add even more value for your best customers?

For example, many small and medium-sized enterprises (SMEs) across Canada rely on this metric to find the right balance between acquisition spending and retention efforts. A Canadian retail business might find its average CLV is $1,000 per customer. That number directly informs how much they're willing to invest to get and keep that person engaged. They often discover that a modest increase in their retention budget can lead to a huge boost in long-term revenue. For a deeper dive into how these calculations shape business strategy in Canada, you can explore some great customer lifetime value insights from BDC.

Why CLV Is a Game Changer for Sales Teams

In sales, it’s all too easy to get tunnel vision. The pressure is always on to close the next deal, hit this month’s quota, and move on. While that hunger is vital, focusing only on the immediate win can mean you're walking right past your most profitable opportunities. This is where truly understanding Customer Lifetime Value (CLV) changes the entire game.

CLV forces a powerful mindset shift—from just making transactions to building strategic relationships. Instead of seeing every lead as a new checkbox, you start evaluating prospects based on their long-term potential. Suddenly, a smaller initial deal from a customer in a high-growth industry looks a lot more attractive than a big one-off purchase from a client who will never need you again.

Prioritizing High-Potential Customers

Once you know your CLV, you can start identifying the DNA of your ideal customer. By digging into your past data, you can pinpoint which industries, company sizes, or specific needs consistently lead to the highest lifetime spend.

This insight gives your reps a superpower: the ability to invest their time where it really counts. They can prioritize outreach to prospects who look just like your best customers, shaping their pitch to solve not just today’s problems but tomorrow's challenges, too. In fact, CLV provides invaluable data that can help your team significantly improve sales forecast accuracy.

This strategic approach naturally leads to better outcomes:

- Smarter Prospecting: Your team stops chasing low-value leads and starts cultivating high-potential relationships that will pay dividends for years.

- Improved Efficiency: Sales cycles become more productive because every effort is focused on opportunities with the highest likelihood of long-term returns.

- Higher Morale: There’s nothing more satisfying than closing deals that blossom into lasting partnerships. It’s a world away from the constant grind of churning through one-time buyers. Having a solid CRM for small business growth is crucial for tracking these interactions and spotting those winning patterns.

The Profitability Power Duo: CLV and CAC

The real magic of CLV happens when you pair it with another critical metric: Customer Acquisition Cost (CAC). Simply put, this is what you spend on sales and marketing to land a new customer.

The relationship between these two numbers—the CLV:CAC ratio—is the ultimate health check for your business model. It tells you whether you're building something sustainable or just spinning your wheels. A healthy ratio means the value you get from a customer over time blows away the initial cost of winning them over.

If your ratio is hovering around 1:1, you’re basically breaking even on every new customer, which leaves zero room for profit or reinvestment. Focusing on CLV encourages sales teams to stop just selling and start selling profitably. It's the foundation for real, long-term success.

How to Calculate Customer Lifetime Value Step by Step

Knowing the idea of Customer Lifetime Value is great, but the real power comes from actually calculating it. The good news? You don't need a Ph.D. in mathematics to get started. A simple, back-of-the-napkin calculation can give you a surprisingly clear picture to guide your sales efforts.

The most straightforward way to get a handle on CLV uses a simple formula that multiplies three core numbers from your business.

CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan

This isn't some abstract theory; it's a practical formula you can use right now. All the data you need is likely sitting in your sales records or your CRM, like LeadFlow Manager. Let's walk through how to find each piece.

Step 1: Find Your Average Purchase Value

First up is the Average Purchase Value. Think of this as the average size of a single transaction or job. It's the typical amount a customer spends with you in one go.

To figure this out, just take your total revenue from a specific period (like a quarter or a year) and divide it by the number of orders you had during that time.

- Formula: Total Revenue / Number of Orders = Average Purchase Value

Let's say your home services business brought in 100,000** in revenue last year from **200** different jobs. Your Average Purchase Value would be **500. Simple as that.

Step 2: Determine Your Purchase Frequency

Next, you need to pin down how often a typical customer comes back to you. This is your Purchase Frequency. Are they a one-and-done, or do they call you every season?

To calculate this, divide the total number of orders by the number of unique customers who placed them.

- Formula: Total Orders / Unique Customers = Purchase Frequency

Using our same example, if those 200 jobs were completed for 50 unique clients, your Purchase Frequency is 4. This tells you that your average customer hires you four times a year.

This visual breaks down the simple, three-part flow for calculating basic CLV.

As you can see, each piece logically connects to the next, building a complete financial story for the average customer.

Step 3: Estimate the Customer Lifespan

The last ingredient is Customer Lifespan—the average amount of time someone remains an active customer. If you've been around for a while, you can look at past customer data to get a solid average. If your business is newer, you can start with a conservative estimate based on your industry.

For our home services company, let's say you've found that customers typically stick with you for about 5 years.

Now, we just plug everything into our formula:

What does this $10,000 number really mean? It means that, on average, a single customer is worth ten grand in revenue over the course of your entire business relationship.

This isn't just a vanity metric. It's a game-changer that immediately shows why keeping customers happy is so critical. This number also becomes incredibly important when you compare it against your Customer Acquisition Cost (CAC), because it helps you answer the crucial question: "How much can I afford to spend to get a new customer and still be profitable?" To dive deeper into that half of the equation, take a look at our complete guide to calculating Customer Acquisition Cost.

CLV in Action Across Different Industries

The formula for Customer Lifetime Value is great, but theory only gets you so far. The real magic happens when you see this metric come to life in the real world. That's when you truly grasp what customer lifetime value is and how it can shape your sales strategy, justify your customer service budget, and point your entire company toward long-term, sustainable growth.

Let's break down how a few different businesses would calculate and use this powerful number.

For a B2B Software Provider

Picture a company selling project management software on a subscription basis. Their typical client is a small business that pays $200 per month and sticks around for about 3 years.

- Average Annual Value: 200/month × 12 months = 2,400

- Customer Lifespan: 3 years

- Calculated CLV: 2,400 × 3 = **7,200**

Knowing that a single client is worth $7,200 completely changes the game for the sales team. It gives them the green light to invest heavily in a smooth, comprehensive onboarding process. Why? Because they know spending that extra time and effort upfront to make sure a new client is successful will pay back big time over the next three years. It's the difference between a quick, transactional sale and building a profitable long-term relationship.

For a Local Home Services Company

Now, let's think about a local landscaping business. A typical customer signs on for a seasonal maintenance package that runs them $1,500 per year. Looking back at their records, they see that happy clients usually stay with them for 6 years.

A $9,000 CLV is a massive insight for this company. It drives home just how critical it is to keep a client happy from one season to the next. Armed with this number, the sales team can confidently create loyalty programs, offer discounts for multi-year contracts, or simply schedule proactive check-ins to catch any issues before they become problems. Each happy client isn't just one season's profit—they're a significant long-term revenue stream.

For a Growing E-commerce Brand

The e-commerce world provides another fantastic example of how CLV can drive strategy. Take a Canadian online retailer, for instance. Reports show an average online shopper might spend CAD 150 per order and make around 3 purchases a year. If the store can keep that customer coming back for 4 years, their baseline CLV is CAD 1,800.

This figure makes it a no-brainer for online businesses to invest in things like loyalty programs and personalized marketing. These aren't just costs; they're investments that are proven to boost retention and can increase the final CLV by as much as 20%. You can discover more about CLV benchmarks in Canadian e-commerce to see how these figures guide business decisions across the country.

These examples make one thing crystal clear: CLV isn't some abstract concept from a business textbook. It's a practical, actionable tool that helps sales teams in any industry make smarter, more profitable decisions every single day.

Actionable Strategies to Increase Your CLV

Figuring out your Customer Lifetime Value is a bit like finding your "you are here" dot on a map. It’s a crucial starting point, but the real work begins when you decide where to go next. The ultimate goal isn't just to have a number—it's to grow that number by building stronger, more profitable relationships with your customers.

Let's dive into a few core pillars that can make a huge difference. These aren't just abstract theories; they're practical, real-world approaches your field sales team can put into action right away to build loyalty and drive revenue.

Boost Average Order Value with Smart Selling

One of the most direct ways to bump up your CLV is to increase how much a customer spends in a single purchase. This isn't about resorting to pushy sales tactics. It’s about genuinely understanding what your customer needs and offering them more complete solutions that solve a bigger problem for them.

- Upselling: This is all about offering a better version of what they're already buying. If a client is seeing great results with your standard service package, maybe they're ready for the premium version with more advanced features.

- Cross-selling: Think about complementary products or services that make their original purchase even better. A landscaping company, for instance, could offer tree trimming to a client who already relies on them for regular lawn maintenance.

This is where a good CRM like LeadFlow Manager becomes your secret weapon. It tracks every past purchase and conversation, giving your reps the context they need to make smart, relevant suggestions that feel genuinely helpful instead of forced.

Increase Purchase Frequency Through Proactive Engagement

Getting customers to come back more often is all about staying top-of-mind and nurturing the relationship you've built. When people feel like you genuinely care about their success, they're much more likely to choose you again and again.

Personalized communication is key here. You can find plenty of inspiration from these lead nurturing examples to boost sales conversion and adapt them for your existing client base. Sometimes, a simple seasonal service reminder or a quick, personalized check-in call based on their last project can make all the difference.

Extend Customer Lifespan with Exceptional Service

At the end of the day, the biggest driver of a high CLV is simply keeping your customers around for a long time. This all comes down to delivering an incredible customer experience, starting from the very first conversation. Solid customer onboarding strategies are a fantastic way to make sure new clients see value right away, setting the stage for a long and happy relationship.

It's a stark reality: one bad experience can undo years of great service. On the flip side, consistently reliable and helpful interactions can turn satisfied customers into your biggest fans. This means giving your team the power to solve problems on the spot and the tools to see a customer’s full history in a single glance.

Just look at the Canadian financial services industry for a powerful example. Financial institutions often keep clients for 7 to 10 years, with a potential CLV that can climb as high as CAD 12,000. They’ve discovered that investing in personalization and loyalty programs can lift retention by 20-30%. It’s a perfect illustration of how strategic investments in the customer journey directly translate into a healthier bottom line.

Got Questions About Customer Lifetime Value? We've Got Answers.

Even after you've got the formula down, putting Customer Lifetime Value (CLV) into practice can bring up some tricky questions. It's one thing to understand the math, but another to use it confidently in the real world.

Let's tackle some of the most common sticking points we hear from sales teams.

How Often Should We Actually Calculate CLV?

There’s no one-size-fits-all answer here; it really depends on the rhythm of your business. But a great starting point for most teams is to run the numbers quarterly or twice a year.

This frequency is the sweet spot. It's often enough to catch important shifts in customer behaviour but not so often that you get lost in minor, insignificant fluctuations. A quarterly check-in, for example, is perfect for seeing how a new sales initiative or a pricing adjustment is affecting long-term value.

The goal is to find a cadence that provides data you can actually act on. Wait too long, and you might miss a critical trend. Do it too often, and you're just reacting to noise.