At its heart, a commission-based sales model is beautifully simple: a salesperson's pay is directly tied to the results they produce. Instead of a fixed salary paid for time spent at a desk, their earnings are a direct reflection of the revenue they bring into the company. It’s all about rewarding the 'what'—the closed deals—rather than just the 'how long'.

The Core Idea Behind Sales by Commission

Think of a pro athlete who gets a bonus for every goal they score. The more they contribute to the team's win, the more they earn personally. A sales by commission model brings that same competitive, results-driven spirit into the business world.

Here, a salesperson's income isn't a flat, predictable figure. It's directly linked to their ability to close deals and generate revenue. This approach creates a powerful, natural alignment between the salesperson's effort and the company's growth. When one wins, they both win.

This pay-for-performance strategy is a world away from traditional salary structures, where pay remains constant regardless of output. Fixed salaries can sometimes create a gap between day-to-day tasks and the all-important bottom line. Commission closes that gap.

Tying Individual Drive to Business Objectives

The real magic of a commission structure is its power to motivate. It reframes a sales role from a simple job with a to-do list into something more entrepreneurial. Every lead, every phone call, and every meeting becomes a tangible opportunity to increase personal income.

This model is especially potent in roles where an individual's contribution is crystal clear and easy to measure, like in field sales or certain inside sales environments.

Getting this model right is the first step toward building a high-performance sales team. The benefits are clear:

- Supercharged Motivation: It directly links financial rewards to sales success, giving reps a powerful reason to push past their targets.

- Smart Cost Control: A huge chunk of your payroll becomes variable, meaning you only pay out when you're making money.

- A Magnet for Top Talent: High-achievers are naturally drawn to structures that don't put a ceiling on their earning potential. They want to be rewarded for their results.

Choosing the Right Commission Structure

Picking the right commission structure is a lot like setting the rules for a game. The rules you choose will directly influence how your team plays, what strategies they use, and ultimately, whether they win. There’s no single "best" way to do it; the perfect structure for your business depends entirely on your goals, your sales cycle, and the kind of product or service you're selling.

Think about it this way: a company that sells high-end enterprise software with a nine-month sales cycle needs a very different incentive plan than a business selling monthly subscriptions directly to consumers. One needs to reward patience and long-term relationship building, while the other needs to encourage volume and speed.

The real key is to make sure the incentive directly drives the behaviour you want to see. Are you trying to aggressively land new logos? Or is your main goal to foster deep, long-lasting client relationships? Each objective points to a different kind of commission model.

Straight Commission: The Pure Performance Model

This is the classic, no-frills approach. With a straight commission plan, a salesperson's entire paycheque comes from a percentage of the sales they bring in. No base salary, no safety net. It’s a pure pay-for-performance system.

This high-risk, high-reward structure tends to attract supremely confident, self-starting sales pros who live for the hunt. You’ll often see it in industries with big-ticket items and relatively quick sales cycles, like real estate or certain high-end retail environments.

Base Salary Plus Commission: The Hybrid Approach

By far the most common model you'll encounter is base salary plus commission. This structure gives reps the stability of a fixed salary but keeps them hungry with commissions on top for every deal they close. It’s the best of both worlds—security and motivation.

There’s a reason this hybrid model is so popular: it’s incredibly flexible. It takes the financial pressure off your team, letting them focus on navigating longer, more complex sales without worrying about a zero-income month. You can also tweak the salary-to-commission ratio to shape behaviour. A higher base might encourage more collaborative, team-oriented activities, whereas a heavier commission percentage really lights a fire under individual performance.

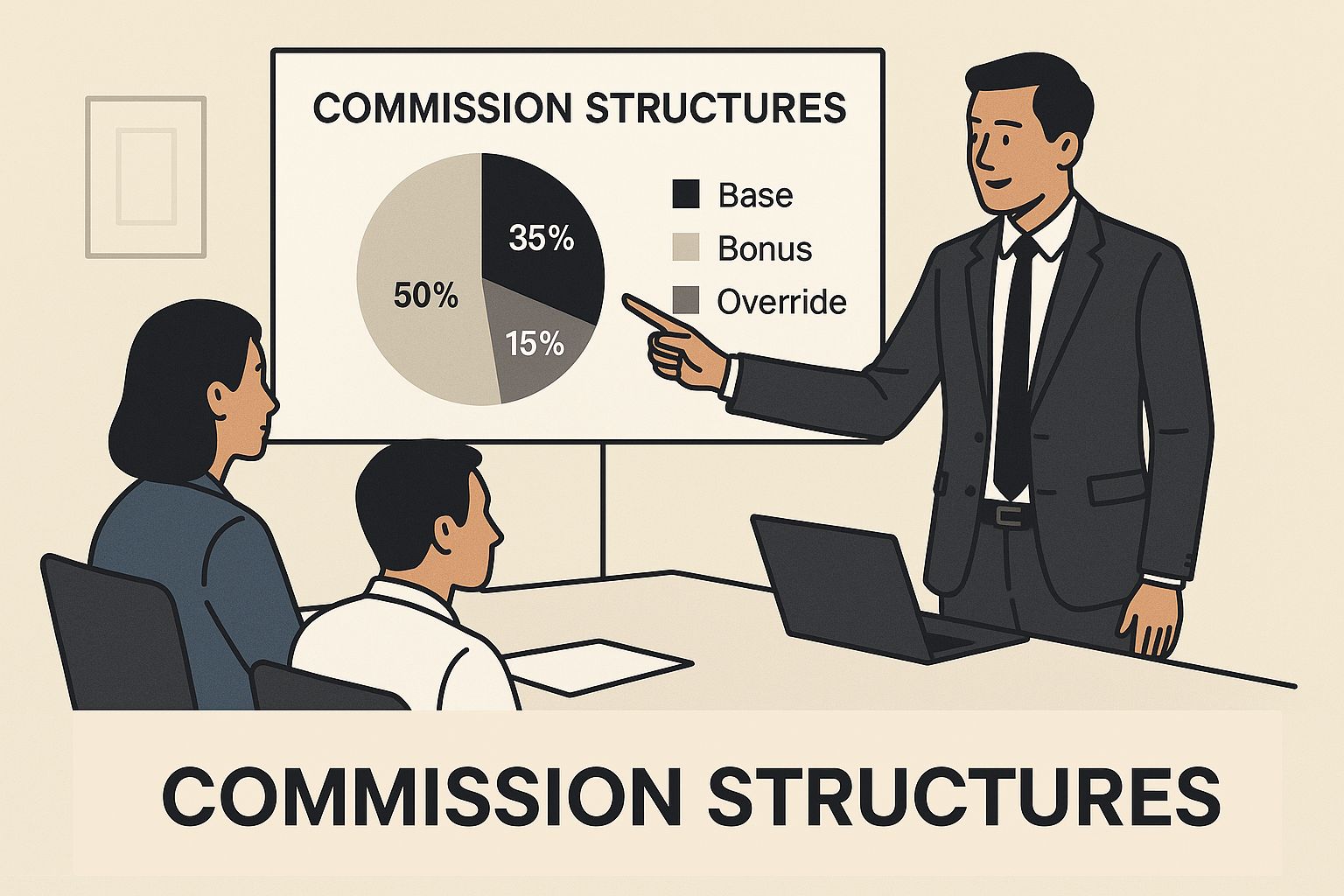

The image below shows how different commission structures fit into an overall sales strategy.

As you can see, each model serves a distinct purpose, whether you're aiming for explosive growth or steady, predictable revenue.

Comparing Sales Commission Models

To make it easier to see how these models stack up against each other, let's break them down side-by-side.

table block not supported

Ultimately, the best model is the one that aligns perfectly with both your business objectives and your company culture.

Tiered Commission: Rewarding The Overachievers

A tiered commission structure is all about rewarding your top performers and encouraging everyone to stretch. In this model, the commission percentage isn't fixed; it actually goes up as a salesperson hits certain sales targets. For example, a rep might earn 5% on sales up to $50,000, but once they cross that line, their rate jumps to 8% on everything they sell.

This creates a powerful incentive for your A-players to keep pushing, even after they've hit their basic quota. It turns a single, monolithic sales target into a series of smaller, more exciting milestones. Getting your tiers right is a critical part of any good sales operations planning guide, as it has a direct impact on your team's day-to-day drive.

This approach works especially well for companies in growth mode that are trying to grab market share as quickly as possible.

Residual Commission: The Long-Term Value Play

For any business built on recurring revenue—think SaaS platforms, insurance agencies, or marketing firms with retainers—the residual commission model is a game-changer. Here, salespeople don't just get paid on the initial sale. They earn a commission for as long as that client keeps paying their bills.

This model is brilliant because it perfectly aligns your sales team's interests with the company's long-term health. It encourages reps to find good-fit customers who will stick around, not just close a quick deal to hit a monthly number. The entire focus shifts from the transaction to the relationship, which is the foundation of any sustainable business.

This isn't just a North American trend, either. In Latin America and the Caribbean, for example, commission-based pay is standard in finance and manufacturing, where rates often fall between 7% and 15%, depending on the local economy.

The Real Pros and Cons of Commission-Based Pay

A sales by commission structure can feel like adding rocket fuel to your sales engine. It creates a direct, powerful link between a salesperson's effort and their paycheck. But like any high-performance system, it has its own unique set of risks and rewards that you absolutely have to weigh.

Getting that balance right is the key to building a compensation plan that truly motivates your team without accidentally creating new problems. This isn't just about paying for results; it's about building a healthy, sustainable sales culture that drives growth for the long haul.

The Clear Advantages of Commission Pay

The biggest, most obvious benefit of a commission model is how it lights a fire under your sales team. When a rep knows their income is directly tied to their performance, every single lead and every conversation suddenly carries more weight. That kind of focus is hard to replicate.

From the company's perspective, this model can be incredibly cost-effective. A huge chunk of your payroll becomes a variable expense, meaning you only pay out big when revenue is actually coming in the door. This financial alignment is a lifesaver for cash flow, especially for growing businesses where every dollar counts.

Here are the main upsides to think about:

- Attraction of Top Talent: Let's be honest, top-tier salespeople are confident. They’re drawn to performance-based pay because it smashes the ceiling on their earning potential. They know they can deliver and want to be paid for it.

- Performance-Based Culture: This kind of pay structure naturally weeds things out. Reps who are driven and accountable will thrive and make a lot of money. Those who can't keep up might look for a more stable role, strengthening your overall sales force over time.

- Direct Alignment with Goals: It gets everyone pulling in the same direction. The entire team becomes laser-focused on the one metric that matters most: closing deals and bringing in revenue.

This alignment can turn a sales department from a simple cost centre into a self-funding engine for growth.

The Potential Downsides and Risks

For all its powerful benefits, a commission-heavy structure isn't a silver bullet. The most immediate issue is the income instability it creates for your team. A couple of slow months can cause very real financial stress for your reps, which can quickly lead to anxiety and burnout.

That pressure can sometimes encourage the wrong kind of behaviour. A desperate rep might get a little too aggressive or pushy, putting a quick sale ahead of what’s actually best for the customer. Over time, that can seriously damage your brand’s reputation and hurt customer retention.

Think carefully about these potential drawbacks:

- Risk of Burnout: The constant pressure to close, close, close can be mentally and emotionally exhausting. This really increases the risk of your best people burning out, leading to higher turnover.

- Complex Administration: Figuring out tiered commissions, draws against commission, and splits can become a real administrative headache. It demands meticulous tracking to make sure everything is accurate and fair.

- Unhealthy Competition: If you don't manage it carefully, a pure commission model can create a "lone wolf" culture. Teamwork and knowledge sharing go out the window when everyone is just focused on their own numbers.

At the end of the day, the goal is to strike a balance. You want to capture the motivational spark of sales by commission while shielding your team and your company from the risks of instability and negative sales tactics. This is why a well-designed hybrid model is often the perfect solution, offering a safety net while still rewarding exceptional performance.

How Economic Shifts Impact Commission Earnings

Commission earnings don't exist in a vacuum. They're tied directly to the health of the wider economy. Think of it like a tide: when the economy is booming, the tide is high, and it lifts all boats. It just becomes easier for your reps to close deals and bring home fat commissions.

In those good times, consumer confidence is up, businesses are opening their wallets, and budgets are looser. Demand is high and sales cycles tend to speed up. For a sales team on commission, this is when the big money is made. It can feel like you’re riding a massive wave of success.

But tides go out. When the economy slows down, so does everything else. Consumers get nervous, businesses put projects on hold, and your sales pipeline can feel like it’s evaporated overnight. This is where the risk in a commission-heavy model really shows its teeth, creating a lot of instability for your team.

Navigating Economic Downturns

During a recession, that same commission structure that once motivated everyone can become a huge source of stress. Your reps might be working harder than ever, but their paycheques are shrinking. It’s a fast track to tanking morale, raising anxiety, and burning out your best people.

This isn’t just theory; we’ve seen it play out time and again. A look at historical data from the Caribbean shows a clear pattern.

This kind of fluctuation really drives home how much commission sales depend on factors completely outside your team's control. You can dig deeper into these economic links by checking out aggregated regional reports on statistical data and remuneration strategies.

Strategies for Building Resilience

Knowing your team is vulnerable is the first step. Smart leaders don't just hope for the best; they build a more resilient ship. That means designing a compensation plan that works in good times and bad.

Here are a few strategies that can help create some much-needed stability:

- Implement Hybrid Models: A solid base salary is a lifeline. It guarantees your reps can cover their bills even when sales are slow, which goes a long way in reducing financial stress.

- Adjust Sales Quotas: Trying to hit boom-time targets during a recession is a surefire way to crush morale. Be realistic and adjust your quotas to reflect the current market. Keep them challenging, but make sure they're actually achievable.

- Introduce Non-Monetary Incentives: When deals are hard to come by, reward the activities that will pay off later—things like lead generation, setting up demos, or nurturing key relationships. This keeps the team focused on the right behaviours.

By building some flexibility into your commission plan, you can keep your team stable and motivated. That way, they’ll be strong, sharp, and ready to hit the ground running when the economy eventually picks back up.

Setting Up and Managing Your Commission Plan

Putting a sales by commission plan into motion is about more than just picking a structure and hoping for the best. To do it right, you need thoughtful documentation, clear goals, and the right tools to track everything. The real aim is to build a system that’s transparent, fair, and actually gets your team fired up to sell.

It all starts with a formal, legally sound commission agreement. This isn't just paperwork; it’s the rulebook for your entire compensation plan, and it needs to be crystal clear. It should spell out commission rates, when people get paid, and exactly what needs to happen for a commission to be earned.

Draft a Clear Commission Agreement

Think of your commission agreement as the constitution for your sales compensation. It’s a vital document that protects both the company and your sales reps by making sure everyone is on the same page from day one. Any grey areas or vague language are just invitations for future headaches and disputes.

Your agreement must explicitly detail:

- Commission Rates: The exact percentage or flat fee for each product, service, or sales tier. No ambiguity.

- Payment Terms: Clarify the trigger point for an "earned" commission. Is it when the contract is signed, when the client pays their first invoice, or after a project is complete?

- Payout Schedule: Define the payment cadence—weekly, bi-weekly, monthly, or quarterly.

- Clawback Clauses: Outline the conditions for reversing a commission, like what happens if a customer cancels and gets a refund.

Getting this document right is a cornerstone of effective sales team management, as it sets the foundation for performance expectations and trust.

Leverage Technology for Accuracy and Transparency

Trying to track commissions manually with spreadsheets is a recipe for disaster. It’s not a question of if a mistake will happen, but when. As your team scales, this manual approach quickly becomes a full-time job riddled with errors and disputes.

This is where a modern sales CRM comes in.

Tools like LeadFlow Manager are built to handle this kind of complexity. They can automate even the trickiest calculations for tiered or residual plans, guaranteeing every rep is paid accurately and on time. That frees up your sales managers to spend their time coaching and strategizing instead of wrestling with a calculator.

A dashboard can give you this kind of immediate clarity.

This kind of real-time visibility gives both reps and managers instant insight into performance and potential earnings.

Establish and Monitor Sales Quotas

With your agreement signed and your tech in place, the last piece of the puzzle is setting sales quotas that are both ambitious and achievable. Quotas are the targets that give your commission structure meaning. Set them too low, and you're leaving growth on the table. Set them too high, and you'll crush your team's morale before they even get started.

Good quotas are built on data. Look at historical performance, market potential, and any seasonal trends. They should be a stretch, for sure, but always feel within reach.

Finally, give your reps a live look at their progress. Nothing fuels motivation more than seeing exactly where they stand against their quota and how much they've earned in real-time. You can find some great sales performance dashboard examples that show you how to bring this data to life. This transparency empowers your team to own their results and drives them to perform.